Services at around 80,000 bank branches in India were hit today as employees of public sector banks went on a one-day strike to protest against consolidation of public sector banks through mergers, and other issues.

Consolidation is a recurring theme. There was a discussion in 1990s on consolidation large banks and small banks. New Bank of India was merged with Punjab National Bank on September 4, 1993. I was then in the Head Office of Punjab National Bank and had seen the merger quite closely. I was closely involved in the finalisation of accounts of New Bank of India as on the merger date and get the merger accounts audited by statutory (external) auditors.

The government has raked up the issue of merger between public sector banks (PSBs), after a long gap. Finance Minister Arun Jaitley said in his budget speech that a roadmap for consolidation would be spelt out, which was followed up by the announcement to set up an expert panel to look into the issue of consolidation. The Indian government’s ultimate aim is to reduce the number of PSBs to about 8-10 from the current 27. On June 15, the union cabinet approved merger of the five associate banks of State Bank of India (SBI) with the parent bank.

The Indian government is pushing consolidation within PSBs as part of one of the reforms it intends to undertake in the banking sector. While the country needs big banks but timing may not be right as banks need to focus on cleaning up of balance sheet first.

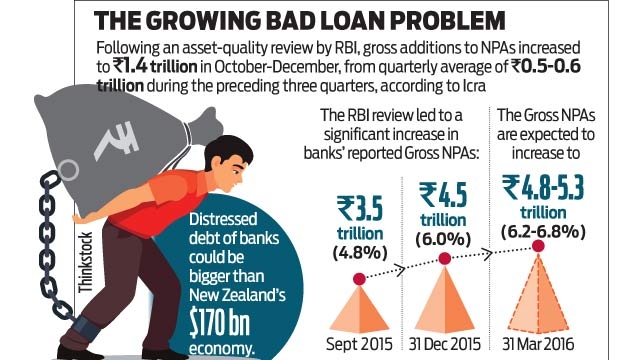

Stressed assets — gross non-performing assets (GNPA) plus restructured assets (RA) — among PSBs have reached alarming proportions of approximately 112% of equity. Indian banks have seen their stressed assets surge to close INR5.9 trillion (USD88 billion) as of March 31, after the Reserve Bank of India conducted an asset quality review (AQR) across the sector and asked banks to classify bad assets appropriately.

The total stressed assets in the Indian commercial banks have risen to 11.5% with the Public Sector Banks leading the strain at 14.5% as at end-March 2016. They still contain some amount of restructured assets indicating potential for some more pain, albeit of lesser intensity.

Mr NS Vishwanathan, Dy. Governor of Reserve Bank of India pointed out that incremental accretion to NPAs is quite substantial. There was a big addition post-AQR exercise. What we need to realise is that, maybe, going forward addition to NPAs may moderate but the provisioning needs as the NPAs age will put pressure on the P&L. This has also put pressure on capitalisation levels as banks have had to put aside more money for provisions against bad loans.

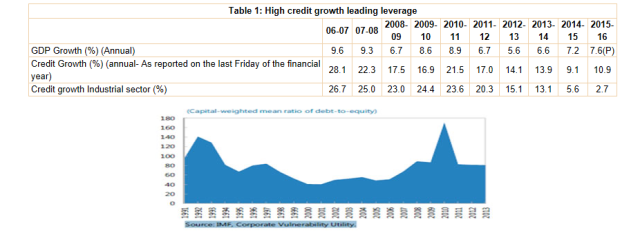

Mr Vishwanathan says that the reasons for the growth in the NPAs are also not far to seek. The bank debt fuelled the rise in corporate leverage steadily from 2005 to 2011. It is worth noting that despite the ‘high leverage’ being a well-established and most widely known risk factor of corporate lending, bank lending to industrial sector continued at an average elevated rate of over 20 percent. Do we call this irrational exuberance? Obviously, an overly leveraged business is more sensitive to turbulence.

Moody’s Investors Service says, in a recent announcement dated June 28, that the Indian Government’s proposal to consolidate the country’s PSBs creates risks that — in the current weak economic environment — could offset the potential long-term benefits.

India’s banking system has witnessed an increase in stressed assets since 2012, with the result that no PSB currently has the financial strength to assume a consolidator role without risking its own credit standing post-merger. From a credit perspective, industry consolidation would strengthen the banks’ bargaining power, help save costs and improve supervision and corporate governance across the banking system. These potential benefits, however, are outweighed by multiple downside risks, says Moody’s.

In particular, the banks’ weakened metrics since 2012 and weak performance mean that many have difficulties meeting minimum regulatory requirements without regular capital injections from the government. As a result, few PSBs have the excess capital required to acquire meaningfully sized peers. Adding to this financial pressure, all listed PSBs are trading at a significant discount to their book value, limiting their ability to attract external capital to support acquisitions.

Therefore, Moody’s believes government support will be a crucial driver of the credit outcome of potential mergers, particularly in the form of the equity capital required to shore up capital buffers.

Finally, Moody’s also sees considerable challenges from potential opposition from employee unions, which could hamper merger efforts and drive up costs. For example, SBI estimates that its merger with the associate banks will cost up to INR30 million (USD0.45 million) due to differences in employee pension schemes.

It makes eminent sense to have a few large banks to get scale, and get synergy, but merger of banks is not going to improve their asset quality in any manner immediately and also the capital requirement will still be there. There are various other factors involved — trade unions, technology, business model and HR. In any case if it starts, it will not happen overnight but the issue is when does the merger happen, is it under a distress situation or under a repair model or is it a happy marriage.

& is it the only solution?

LikeLike

Definitely not under a distress situation or in a highhanded manner.

LikeLiked by 1 person

how they propose to fund & how long ? No mention of this anywhere .

LikeLike

Where’re the funds needed for banks? Big, sound banks should be allowed to go to public. Government better go for effective regulation. For weaker banks, Government may bring back recapitalisation bonds as it had done it in 1990s, with a minimum effect on budget and revenue deficit.

LikeLike

The mounting bad debts is a matter of grave concern as rightly highlighted by you. Also, financial constraints and incompatibility between banks may be a serious threat that really requires key strategizing and commitment. Looks like there is a certain pattern and cycle to merger and then again going separate ways..

LikeLiked by 1 person

Hope with the passing of the Enforcement of Security Interest and Recovery of Debts Laws and Miscellaneous Provisions (Amendment) Bill today by Lok Sabha along with the Insolvency and Bankruptcy Code passed in May, there will be some faster recoveries and improvements in bad debt situation.

High bad debts not only raise the borrowing costs but also impact in credit delivery.

LikeLike

Sir, as you have pointed out If the merger costs outweigh the synergies gained, the benefits will be hard to accrue, at least in the short term. Also how will the merger improve the existing non performing assets, On one hand it is easier to implement good governance framework, and have reduced cost of operations post consolidation, on the other hand the banks may become too big and maybe unapproachable for small borrowers.

LikeLiked by 1 person

Your apprehensions are quite justified. As the banks grow in size their products/ service level also change. India do need some mega banks to finance the big projects, infrastructure financing, large ticket trade finance, but that doesn’t mean that there’s no scope for small banks. RBI is giving licenses to small banks and payment banks to serve the unbanked areas, primarily. We need to balance our plan with our need and grow. It cannot be a single dimensional trajectory. You can see in the US they have community banks, credit unions running side by side JPMorgan or Citibank. Also, technology is a big enabler. We are getting some new fintech startups doing good business and they too have an excellent future, if regulated prudently.

LikeLiked by 1 person

Yes a right mix is required.

Presently the financing of infrastructure projects is mostly done by a consortium of lenders, which distributes the risk as well. Sir want to understand how it helps if instead of a consortium the projects are financed by a single lender?

LikeLiked by 1 person

The idea is not to change from a consortium of banks to a single bank, not to concentrate the risk at one place. Larger size of the banks give better bargaining power in the hands of the banks for effective monitoring of the assets/business lent.

With the increased requirement of capital to meet the latest Basel III requirements, banks need to raise capital to be able to finance and be on operation. Every loan is a risk. There is a limit to which a bank can take on risk, which is guided by Capital Adequacy Ratio, Leverage Ratio etc. More the capital, more is the risk taking ability of the bank.

Good banks can subsidise the capital requirement of a bad bank if the bad bank is merged to it. This will ease the pressure on government to recapitalise the PSU banks.

Again very large size comes with different issues. All systemically important banks have to maintain additional capital, higher than other banks so as to avoid “too big to fail” situation.

Consolidation improves efficiency, increases synergy, rationalises branch networks, boosts competitiveness. However, a merger should not be done under a distress situation or in a highhanded manner.

LikeLiked by 1 person

I see..easing the pressure for recapitalisation of PSU banks is a key factor in favour of consolidation.

LikeLiked by 1 person